A Nimble Mechanism to Accelerate Climate Finance

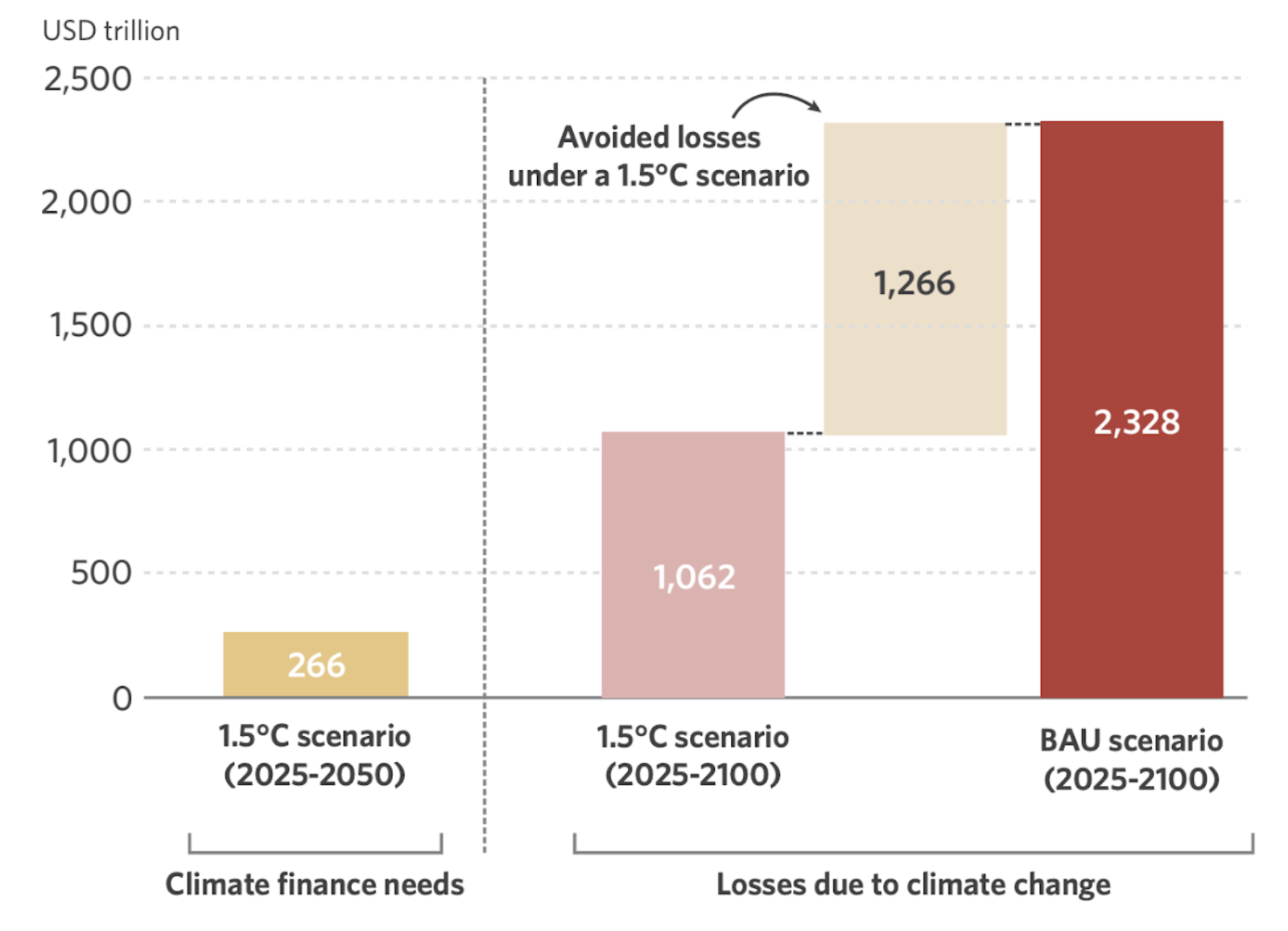

Climate finance is fundamental to addressing climate change, but current flows are far from the levels needed. The Climate Policy Initiative estimated climate finance needs to be USD 10 trillion annually until 2050. However, current investments are floating just above USD 1 trillion annually. While development financial institutions and multilateral climate funds are part of the solution, their capital flows are nowhere near sufficient and are concentrated in developed economies.

Carbon markets are an opportunity to accelerate financial flows into climate change mitigation and adaptation. The focus of this blog post is on the Voluntary Carbon Market (VCM), which, unlike compliance markets, is unregulated and independent of governmental legislation. For readers unfamiliar with carbon markets, the United Nations Environment Programme and the United Nations Development Programme provide helpful introductions.

As a market-based mechanism, the VCM enables the trade of carbon credits quickly, moving capital faster than more bureaucratic funding mechanisms. They also channel private capital into societal benefits, as the credit market is largely driven by private entities striving to reach voluntary net-zero targets. Finally, carbon markets facilitate international trade, channeling funds into developing countries to support their mitigation and adaptation efforts.

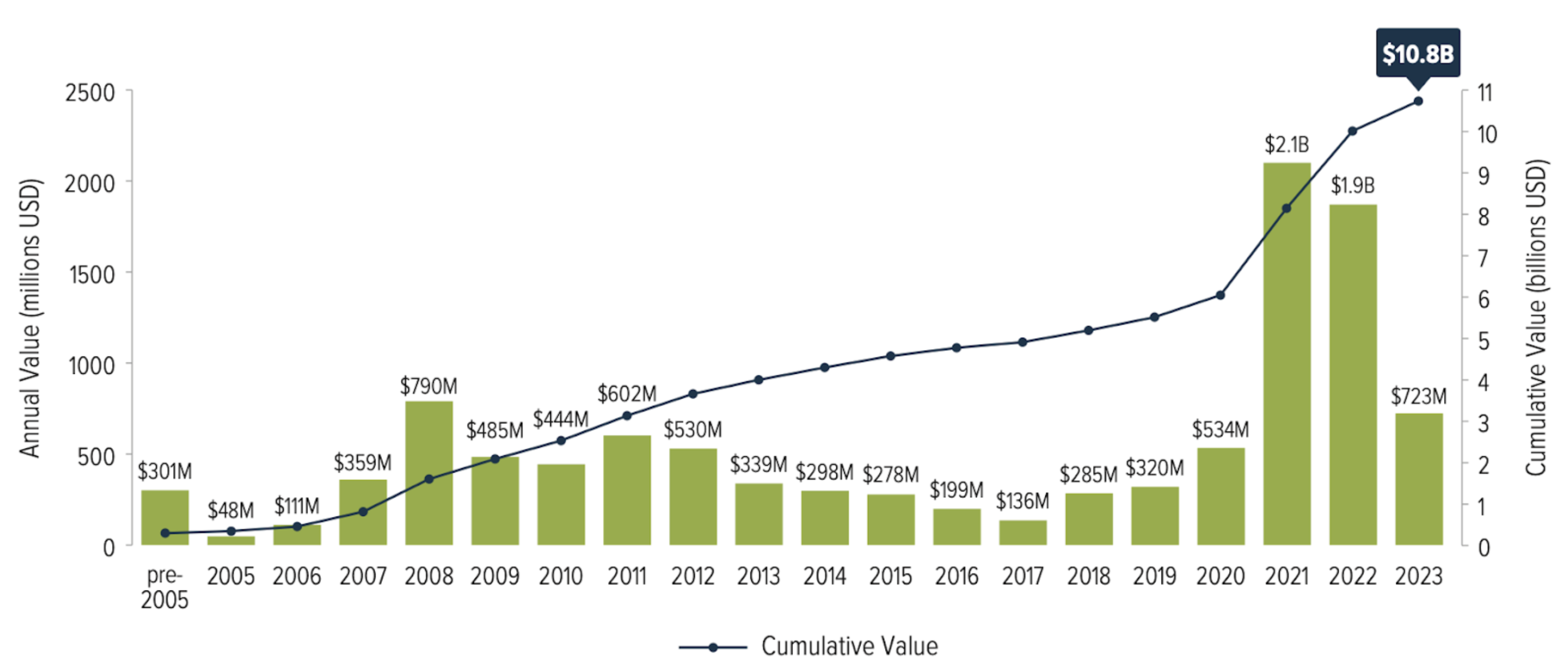

However, the VCM is facing significant challenges to scale. At its peak, it was valued at USD 2 billion, a fraction of what is needed to meet global climate goals. The market is estimated to grow twenty-five fold by the end of the century, but the path to scale is uncertain due to ongoing challenges. The obstacles incurred by the VCM can be categorized into supply and demand challenges, and ultimately revolve around issues of integrity and market confidence.

A Wake-Up Call

On the supply side, there are questions regarding the integrity of carbon markets. In 2023, The Guardian exposed one of the largest offset crediting registries, Verra, reporting that over 90% of their forest credits were worthless. Major corporations like Gucci, Disney, and Shell claimed carbon neutrality based on so-called “phantom credits” that did not bring real emission reductions. The lack of government regulation around market design has led to conflicts of interest, which allowed registries that earned a fee for each credit they issued to soften quality standards in a market that was emerging and still learning.

The scandal triggered increased scrutiny of carbon credits, which further dampened supply and demand in an already sluggish market. After peaking in 2021, the value of the VCM fell to USD 723 million in 2023 and the volume of credits more than halved from 253.8 MtCO2e in 2022.

However, the scrutiny also created a push for higher quality credits. Initiatives like the Integrity Council for the Voluntary Carbon Market (ICVCM) are responding to concerns by raising the quality benchmarks for the VCM. The ICVCM’s Core Carbon Principles aim to steer the market towards more unified and higher-quality standards, to guarantee that the credits traded are truly additional, permanent, quantifiable, transparent and traceable.

Digitalization will also support the integrity efforts of the VCM. Digital and Web3 technologies will enable more accurate and transparent Measurement, Reporting, and Verification (MRV) of carbon credits, which will increase accountability while streamlining operations and reducing transaction costs.

Looking Behind the Vast Price Range

Another important challenge facing carbon markets is the pricing of credits. Every credit should equal 1 metric ton of CO2e avoided, reduced, or removed from the atmosphere, yet the price range is vast. Methane emissions reduction credits can sell for as low as USD 1-2 per tonne whereas Direct Air Carbon Capture & Storage (DACCS) credits sell for over a thousand dollars per tonne.

Prices largely determine if conducting a project is profitable or not and, unfortunately, they are too low to sustain a business case in many project areas.

While certain price differences are inevitable due to factors like implementation costs, part of the differentiation is arbitrary. Prices are largely determined by the demand of buyers, who often make choices based on the perceived charisma rather than the environmental integrity of credits.

For instance, there is growing interest in cookstove credits, which claim emission reductions by substituting toxic cookstoves with clean alternatives in developing countries. The societal benefits are clear: they reduce air pollution and premature deaths while empowering women, who are often responsible for cooking and exposed to the health and safety hazards of traditional cookstoves. Such credits are more attractive and marketable than, for example, credits based on capping abandoned oil wells to avoid methane emissions.

However, perceived co-benefits do not always reflect a credit’s environmental integrity or verified co-benefits. Credit rating agency Calyx Global found that there is often an inverse relationship between the environmental integrity of a credit and its Sustainable Development Goals (SDGs) impact. Cookstove projects, for instance, often face over-crediting issues.

The pricing of credits also depends on the protocol adopted to calculate the emissions benefits of a project. Currently, the VCM relies on 100-year Global Warming Potential (GWP100) to calculate the emission benefits of a project. This implies a long-term approach to mitigation, which undervalues the potent, short-term impact of short-lived climate pollutants (SLCPs).

Consider a project that delivers credits by stopping methane leaks from abandoned oil wells. If we use GWP100, reducing one ton of methane is deemed equivalent to reducing 28 tons of CO2, so 28 carbon credits will be sold. Instead, if we use GWP20, reducing one ton of methane is equivalent to reducing 80 tons of CO2, which will yield 80 credits. Allowing project developers to sell more credits per project incentivizes a higher supply of SLCP credits and thus near-term climate action.

As the world is on the brink of crossing the 1.5 °C warming threshold, there is rising interest in addressing SLCPs to curb near-term global warming. To avoid climate overshoot and achieve our long-term climate targets, adopting a dual approach to near- and long-term emissions mitigation is instrumental. A potential solution is to use appropriate near-term metrics (such as GWP20) for SLCP mitigation credits and GWP100 for long-term mitigation credits.

The supply of high quality credits is low but increasing thanks to undergoing efforts to increase credit integrity.

Rebuilding Market Confidence

The scandals and subsequent scrutiny have also affected the demand for carbon credits in the VCM. Before The Guardian’s and other investigations, private companies, which are the drivers of the VCM, sought the cheapest credits to make carbon neutrality claims without much concern about their quality. Now, companies are subject to higher monitoring and disclosure standards and are much more concerned about the quality of their credit purchases. While this implies a push for higher quality, it also implies a fall in demand. After the overcrediting scandals (with forestry and cookstove credits, among others), buyers are wary of buying carbon credits out of fear of being exposed and compromising their reputation.

Confidence in the VCM is low. The scrutiny is burying the increasing high-quality credits in the dark, which calls for organizations to highlight success stories to restore market confidence and stimulate demand. Communicating the ongoing efforts to improve credit integrity on the supply side is key to restore market confidence and buy-side interest.

Even after deciding to engage the VCM, navigating the market brings its own challenges. Because of the high market fragmentation, buyers face many decisions in the procurement process, from choosing what credits to buy on which registry, to how to disclose them and what claims to make. As integrity benchmarks are being redefined, buyers face risk in any of these steps.

The clear definition of credit quality and the use of digitalization for MRV are examples of undergoing improvements that will simplify the procurement process and reduce risk for buyers.

Various players are creating buyer guides to navigate the VCM. For instance, sustainability data platform Watershed offers an introductory guide to different credit types and questions to consider when purchasing carbon credits. Platforms like Salesforce address the complexity of navigating the VCM by offering a simplified e-commerce experience for buyers to find projects and evaluate their quality to best achieve their own goals. Demystifying the procurement process and reducing associated risks is key to increasing buyer engagement and scaling carbon markets.

While demand recovers, there are initiatives to signal to project developers to ramp up the supply of high-quality credits. Major companies have come together through Advance Market Commitments to create demand guarantees for credits supplied in the future. The first of this kind was the LEAF Coalition, which was launched by Emergent to invest USD 1 billion in jurisdictional avoided deforestation credits. There are three more buyer consortia to date (Frontier, NextGen, and Symbiosis), for a total commitment of USD 3-4 billion.

The Role of Offsets

There is still confusion about the role of offsets in an organization’s strategy, especially after the Science Based Target Initiative (SBTi) criticized the use of carbon credits to meet emissions reduction targets due to inflated climate benefits. So, how should offsets be used?

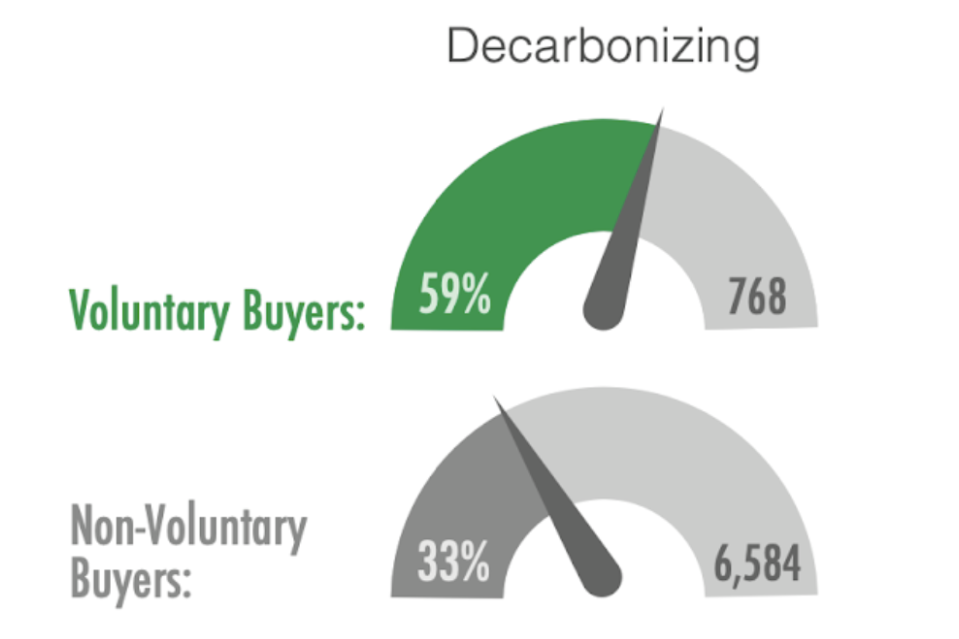

Carbon credits should not be an excuse to avoid internal mitigation of greenhouse gas emissions. Decarbonization strategies such as switching to renewables and driving electric vehicles guarantee permanent emissions reductions. However, for some sectors and companies, complete mitigation of hard-to-abate emissions may not be possible yet. Carbon offsets help bridge this gap.

The same is true for Scope 3 emissions; pushing companies down the value chain to decarbonize can work in tandem with investing in high-quality carbon credits for hard-to-abate cases.

A common misconception is that companies use credits to buy their way out of decarbonization. Studies have shown that companies that buy carbon credits do so as part of a comprehensive decarbonization strategy and spend 3 times more than non-buyers of carbon credits on emissions reductions. By definition, VCM participants engage with climate change mitigation beyond regulatory expectations.

We Need all the Tools in our Toolbox

In the face of market challenges, participants are increasingly contributing solutions that will improve the efficacy and integrity of the market and restore trust.